Funding

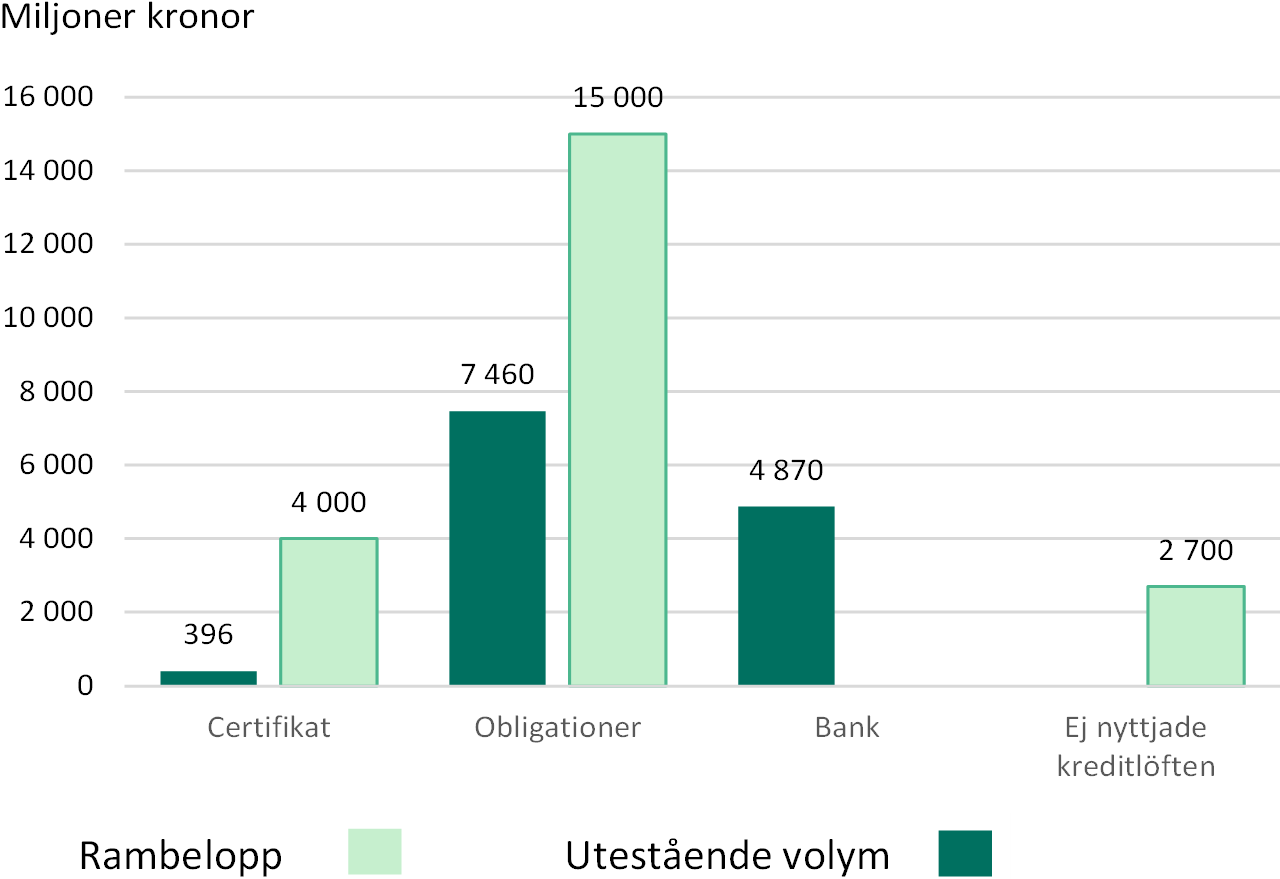

Humlegården strives for a diversified funding structure with various sources of financing in the bank and capital market. To limit refinancing risk, we endeavour to ensure an evenly distributed maturity structure and aim for average capital tied-up to exceed three years.

Financial risks and targets

| Policy | 2024-06-30 | 2023-06-30 | 2022-06-30 | |

| Target | ||||

| Loan-to-value ratio, % |

not by active action exceed 50 |

32,2 |

31,9 |

30.4 |

| Debt ratio |

13.0 |

8,8 |

9,3 |

10,4 |

| Interest-coverage ratio, multiple |

min 2.0 |

4,0 |

4,1 |

6,0 |

| Interest-coverage ratio, rolling twelve months | ||||

| Financing risk | ||||

| Capital tied up period, years | min 2 | 3,7 | 3,3 | 3,3 |

| Loan maturity, 12 months, % | max 35 | 4 | 16 | 9 |

| Loan commitments and cash and cash equivalents, 5 months, % |

min 100 | 652 | 149 | 182 |

| Interest risk | ||||

| Fixed-interest period, years | min 2 | 4,0 | 3,5 | 4,1 |

| Fixed-interest period, maturity, 12 months, % | max 70 | 8 | 31 | 31 |

| Credit risk | ||||

| Counterparty rating | Lowest A- | fulfilled | fulfilled | fulfilled |

| Currency risk | ||||

| Currency exposure | not permitted | fulfilled | fulfilled | fulfilled |

Key figures

| 2024-06-30 | 2023-06-30 | 2022-06-30 | |

| Secured financing | 12 | 13 | 11 |

|

Unsecured properties - MV, % |

77 | 76 | 76 |

| Green financing | |||

|

Share of green financing, % |

100 | 100 | 100 |

|

Interest |

|||

|

Average interest on the balance sheet date, % |

2,9 | 2,6 | 1,5 |

Nominal amount

(SEK m) at 2024-06-30

| Maturity | certificate | Bonds | Bank loan | Total | Share | Interest due | Share, % |

|---|---|---|---|---|---|---|---|

| 198 | 198 | 2% | |||||

| Year 1 | 344 | 0 | 344 | 3% | 1 052 | 8% | |

| Year 2 | 1240 | 2100 | 3 340 | 26% | 350 | 3% | |

| Year 3 | 2 100 | 0 | 2 100 | 17% | 3 800 | 30% | |

| Year 4 | 930 | 2 400 | 2 970 | 23% | 1 000 | 8% | |

| Year 5 or later | 2 250 | 1 500 | 3 750 | 30% | 2 750 | 22% | |

| Total | 198 | 6 864 | 5 640 | 12 702 | 100% | 12 702 | 100% |